Today, the Office of the U.S. Trade Representative (“USTR”) issued a statement and the expected draft notice following release of the 193-page USTR Report on its statutory four-year required review of China Section 301 additional duties. The draft USTR notice, which will be published soon in the Federal Register, provides a 30-day public comment period on USTR proposals to:

- Increase tariffs on specific China products in 14 “strategic sectors,” and

- Institute an exclusion process for particular machinery used in domestic manufacturing and grant 19 temporary exclusions for certain solar manufacturing equipment.

Public comments may be submitted electronically on the USTR web portal https://comments.ustr.gov/ between May 29, 2024 and June 28, 2024.

A. Section 301 Duty Increases

Annex A of the notice identifies the specific HTSUS classifications subject to the proposed China Section 301 duty increases and timing. Annex A includes a total of 387 8-digit and 10-digit HTS “strategic sectors” tariff provisions covered by the China Section 301 duty increases scheduled for August 1, 2024, January 1, 2025, or January 1, 2026.

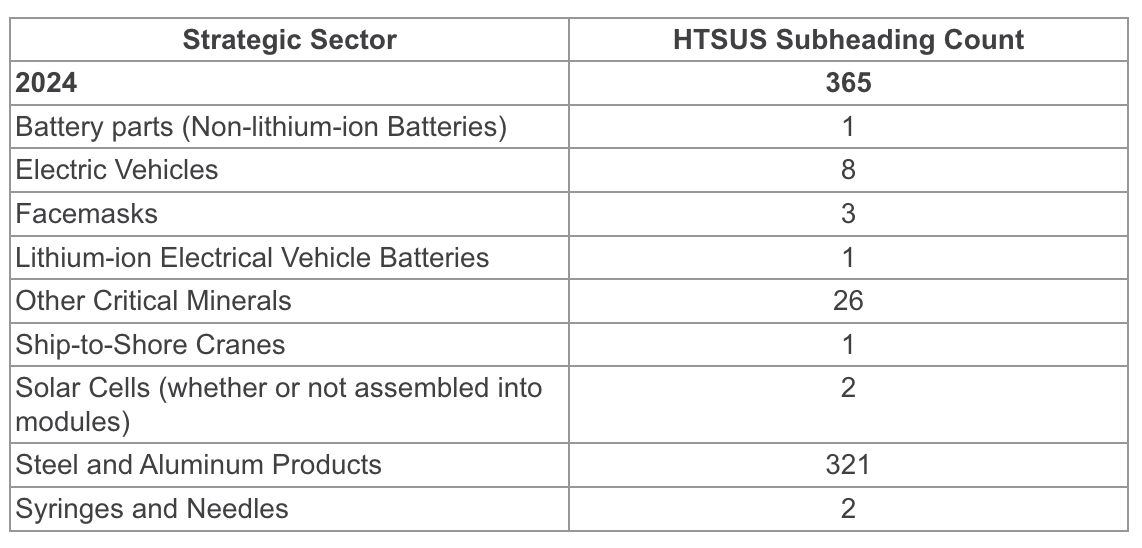

- August 1, 2024. Duty increases scheduled for August 1, 2024 include 365 HTS classifications in 9 strategic sectors, covering mostly steel and aluminum HTSUS provisions, as follows:

All the August 1, 2024 proposed increases are to 25%, except for (1) solar cells and syringes needles (50%), and (2) motor vehicles classified in HTSUS subheadings 8702.40.31, 8702.40.61, 8702.90.31, 8702.90.61, 8703.60.00, 8703.70.00, 8703.80.00, and 8703.90.01 (100%). - January 1, 2025. Proposed increases scheduled for January 1, 2025 include the Semiconductor “strategic sectors” category which would increase China Section 301 duty rates to 50% for 16 HTSUS provisions, including 8-digit HTSUS provisions such as diodes, transistors, photosensitive transistors, and electronic integrated circuits classified in HTSUS subheadings 8541.10.00, 8541.21.00, 8541.29.00, 8541.30.00, 8541.49.10, 8541.49.708541.49.80, 8541.49.95, 8541.51.00, 8541.59.00, 8541.90.00, 8542.31.00, 8542.32.00, 8542.33.00, 8542.39.00, and 8542.90.00.

- January 1, 2026. Proposed increases for January 1, 2026 include a duty increase to 25% for 6 HTSUS provisions covering lithium-ion batteries, medical gloves, natural graphite, and permanent magnets classified in HTSUS subheadings 8507.60.0020, 4015.12.10, 2504.10.10, 2504.10.50, 2504.90.00, and 8505.11.00.

B. Potential Machinery Exclusions and Solar Equipment Exclusions

Annex B of the USTR notice includes details on machinery used in domestic manufacturing that will potentially be eligible under a product exclusion process. Annex B mirrors Appendix K of the USTR Report and includes some, but not all, machinery classified under 8-digit tariff lines in HTSUS Chapter 84 and Chapter 85. There are 312 8-digit HTSUS provisions. Only 26 of the provisions are in HTS Chapter 85 (i.e., Headings 8514, 8515, and 8543).

The USTR notice indicates that interested persons may request that (1) particular machinery used in domestic manufacturing and (2) classified within the specified HTSUS Chapters 84 and 85 8-digit provisions to be temporarily excluded from Section 301 tariffs. These are the only HTS provisions eligible for consideration for requesting exclusions on this process. If granted, the temporary exclusions will only be effective through May 31, 2025.

The notice indicates the USTR will also (1) publish a separate notice with additional information on the procedures for requesting exclusions under this process, and (2) post a copy of questions for the docket at https://comments.ustr.gov by May 24, 2024. Nevertheless, because the comment period is limited to May 29, 2024 through June 28, 2024, it makes sense for importers to immediately review their imports to identify China products classified in the Annex B 8-digit HTS provisions which may benefit from a product exclusion. Based on the language of the notice and USTR past practice in China Section 301 product exclusions, it will probably be best for comments to advocate for the creation of temporary product exclusions with specific product description language classified in the eligible 8-digit HTS provision. The notice indicates that comments may be filed on machinery used in domestic manufacturing in HTSUS Chapters 84 and 84 that was not already listed in Annex B.

Annex C of the notice includes 19 types of solar manufacturing equipment classified in HTSUS subheadings 8486.10.0000, 8486.20.0000, and 8486.40.0030 eligible for a temporary product exclusion. This is the same list which was included as Appendix L of the USTR Report. The Notice indicates these proposed exclusions will be effective from the date of the notice through May 31, 2025. The USTR notice provides no information on the existing China Section 301 product exclusions set to expire May 31, 2024.

The impact on foreign trade zone (FTZ) on-hand inventory of China products remains unclear at this stage, as the USTR notice does not include any discussion on application of modified Section 301 duties to FTZs. FTZ operators and users are encouraged to comment.

Companies should be considering filing comments and short-term and long-term strategies. Please contact Marshall Miller, Brian Murphy, or Sean Murray with questions or for assistance in preparing and filing public comments and exclusion requests. Please contact us if you want to be provided an Excel spreadsheet we have prepared of the USTR notice Annex A, B, and C tariff provisions.