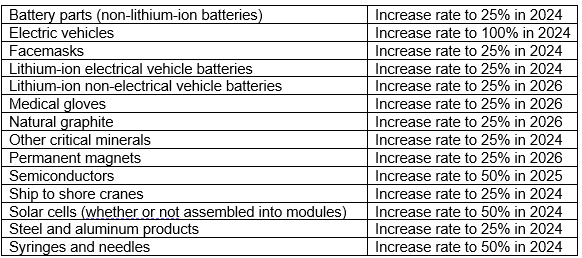

Today, statements have been issued by both the White House and Office of the U.S. Trade Representative (“USTR”) on the release of a 193-page USTR Report on its statutory four-year required review of China Section 301 additional duties. The report recommends that (a) the Section 301 tariffs remain on China products currently subject to them, and (b) China Section 301 tariffs be increased for certain goods in strategic sectors:

The duty rate increases are proposed but not yet in effect, and the HTSUS classifications and exact timetable are uncertain. Next week, the USTR will issue a Federal Register notice announcing procedures for interested parties to comment on the proposed increases in the Section 301 tariffs. This notice should provide additional details on the HTSUS provisions subject to increased duty rates and the timing of the increases. The impact on foreign trade zone (FTZ) on-hand inventory of China products is unclear at this stage.

The USTR report also recommends:

- Establishing a product exclusion process for certain machinery used in domestic manufacturing, including proposing 19 temporary exclusions for certain solar manufacturing equipment;

- Allocating additional funds to U.S. Customs and Border Protection for greater enforcement of Section 301 actions;

- Greater collaboration and cooperation between private entities and government authorities to combat state-sponsored technology theft; and

- Continuing to assess approaches to support diversification of supply chains to enhance U.S. supply chain resilience.

The USTR Report provides some details on machinery used in domestic manufacturing that will potentially be eligible under a product exclusion process. Appendix K of the report identifies some, but not all, machinery classified under 8-digit tariff lines in HTSUS Chapter 84 and Chapter 85. There are 312 8-digit HTS provisions, with only 26 HTS Chapter 85 provisions in Headings 8514, 8515, and 8543. Appendix L of the report indicates that the solar manufacturing equipment potentially eligible under a temporary product exclusion process is limited to certain items classified in HTSUS subheadings 8486.10.0000, 8486.20.0000, and 8486.40.0030. The Federal Register notice to be issued next week will also include procedures for interested parties to comment on the proposed exclusion process. Companies should be considering short-term and long-term strategies.

Please contact Marshall Miller, Brian Murphy, or Sean Murray with questions or for assistance.